- Home

- FAQs

Frequently asked Questions

EDGE REWARDS does its best to deliver your rewards to you on time. However, minor delays can occur from time to time. In case of a delay, you can check the status of order in the Order Status page after logging in to the website. In case there seems to be a problem with the delivery, you can also call our Customer Service Number at 1860-419-5555, 1860-500-5555 or reach us at axisbank.com/support. (You need to inform us within 30 days of date of redemption).

EDGE REWARDS sends you SMS’s and emails at every step of the dispatch and delivery process so you are kept informed. You can also track the status of your delivery by logging in to www.edgerewards.axisbank.co.in>My Transaction History

Delivery will be made only at the registered address, and in case of e-voucher, at the email ID registered with the bank. In case the member has changed his address recently, he would need to visit the nearest Axis Bank branch to request for a change in address. The same holds true in case a change has to be made in the email id registered with the bank.

No delivery will be made to P.O. Box addresses or to addresses outside India, unless otherwise explicitly mentioned in the catalogue.

Your e-vouchers will be delivered to your registered email ID. Store vouchers and physical products are location specific and would be delivered to the registered address.

You can have your rewards delivered only to addresses registered with Axis Bank. This includes communication addresses, email addresses and Mobile numbers. If you wish to update your communication / shipping address, you will need to visit the nearest Axis Bank branch with the relevant documents. To update your email address you can update it on Internet Banking, and to update Mobile Number, you can either visit your nearest branch, or an ATM.

Do note that even if you’ve provided an alternative email address at the time of registering for EDGE REWARDS , this does not impact the email address you’ve registered for Axis Bank Account, cards or loans.

No, you can only have the gift sent to your address. However, you can always send the gift forward once you’ve received it.

In case you’re facing a problem with redeeming points with Partner Brands, you can call our Customer Service Number at 1860-419-5555 or 1860-500-5555 or reach us at axisbank.com/support to get further help.

- a. Online Rewards will be delivered to your bank registered email ID, instantly. In case of unforeseen delays,it will be delivered within a maximum of 24hours. Instant e-Vouchers once redeemed cannot be cancelled.

- b. Gift vouchers will be delivered in 6 working days

- c. All other products including multiple reward redemptions will be delivered in 9 working days for Metro* cities and in 9-13 working days for Non-Metro cities.

*Cities covered under metros: Delhi, Noida, Gurgaon including NCR region, Mumbai, Vashi, Thane, Chennai, Kolkata, Bengaluru, Pune, Hyderabad, Secunderabad, Ahmedabad, Chandigarh, Jaipur, Indore

In case you aren’t satisfied the quality of the reward you’ve received, or you believe that there has been damage in transit, you can call our Customer Service Number at 1860-419-5555 or 1860-500-5555 or write to us at edgerewards@axisbank.co.in. You will need to quote your transaction ID, which is available on https://edgerewards.axisbank.co.in/lms > My Transaction History. You also need to keep all the packing material etc intact for scrutiny. You will need to register this complaint within 3 days of receipt.

Pin Code Serviceability check provides an indicative delivery schedule of the rewards redeemed. The number of days displayed to deliver the rewards redeemed are approximate timelines based on delivery schedules of courier companies.

At the time of redemption, you can check the indicative delivery TAT of the rewards redeemed and to be delivered.

Here is a step-by-step guide for Pin Code Serviceability check option:

- a. Select the reward from the reward store and click on ‘Redeem Now’ button

- b. Enter the PIN code in the ‘Check Availability’ tab and click on Check.

- c. You will get to know the information on indicative delivery schedule based on your PIN code.

Recharges & Bookings is a new segment introduced on EDGE REWARDS website. We now offer real time redemptions online across 6 categories. You can now book flight tickets, make hotel reservations, buy movie tickets, download music, recharge your mobile and DTH services and also pay mobile bills instantly using your EDGE REWARD Points.

The minimum points requirement for redemption is 300, as the first redemption of 450 points will take your account balance to less than 300, the system will not allow the second redemption of 200 points to go through. You can redeem only one product in this case.

As you will be redeeming a product under the ‘Recharges & Bookings’ store using your EDGE REWARD Points, there will be no additional charges. All applicable taxes are factored in the total points required for redemption.

Yes, you can redeem services from the ‘Recharges & Bookings’ store by paying with points and cash. However, you need a minimum of 300 points to use the Points Plus Pay feature. Currently, the service is available on website only. Below is a list of categories where in ‘Points Plus Pay’ can be used:

| Category | Points Only | Points Plus Pay |

|---|---|---|

| Flight Tickets | ✔ | ✔ |

| Hotel Booking | ✔ | ✔ |

| Movie Tickets | ✔ | ✔ |

| Music Download | ✔ | ✗ |

| Mobile Recharge | ✔ | ✔ |

| DTH Recharge | ✔ | ✔ |

No. Currently, you can only use Axis Bank Credit or Debit Cards to redeem products from ‘Mobile & DTH recharges,Travel, Hotel & Movie bookings or Music downloads.

Yes, you will earn points if you use an eligible Axis Bank Credit/ Debit card while using ‘Points Plus Pay’ feature to redeem at ‘Recharges & Bookings’ store.

Yes, you can book domestic and international flights by using your EDGE REWARD Points. Choose appropriate option as per your travel plan once you are on the website.

Yes, you can book a round trip using your EDGE REWARD Points. Action the redemption using the round trip option available on the website.

Only one flight ticket can be booked at a time on the ‘Flight Booking’ store. For any other flight booking a new redemption request will have to be placed.

Yes, you can redeem your points to book flight tickets for your friends or family members.

For cancellation, you will need to contact the participating airline directly or call the agent through phone. EDGE REWARDS platform does not support flight cancellations.

However, for refunds, you will need to inform Axis Bank customer service team at 1860-419-5555 or 1860-500-5555 within 48 hours from the time of cancellation.

The cancellation policy will be governed by the terms & conditions of the participating airline merchants. Every booking made is subject to cancellation charges levied by the airline, which may vary by flight and booking class. The charges may be verified with the airline and airline service provider by the member. For more details, please visit the Terms & Conditions.

EDGE REWARDS does not support change or modifications in flight bookings once redeemed. Please call the participating airline for any modifications required in the bookings made. You might need to pay the additional price difference directly to the airlines as per the airline policy.

Post cancellation request is processed by the participating airline partner, the applicable refunds will be credited in 15 working days.

In case you have opted for ‘Points Plus Pay’ facility while booking flight tickets, the cancellation fees will be deducted from the points and cash paid before processing the refund request.

There will be no refund for 'no-shows' or any partially unused flights.

While redeeming for flight tickets at the ‘Recharges & Bookings’ platform, if EDGE REWARD Points get deducted and the redemption does not go through, the points will be credited into your account in 1 hour. If the services are being redeemed partially by points and cash, the amount paid by cash will be credited to your account in 7 working days.

Yes, you can make hotel reservations for national and international locations.

Only one hotel booking can be made at a time at the ‘Recharges & Bookings’ store. For any other hotel booking a new redemption request will have to be placed.

Hotel stay would include only the room charges. All amenities displayed by the hotel while redeeming will be a part of the package. If any amenities are chargeable, the same will be specifically displayed on the website and will be charged directly.

For cancellation, you will need to contact the participating hotel partners directly or call the agent through phone. EDGE REWARDS platform does not support hotel cancellations.

Every hotel has a different cancellation policy and the user shall be charged according to the Hotel/Room cancellation policy. Every booking made is subject to cancellation charges levied by the hotel. The participating hotel partner charges a separate service fee of Rs.300 for all offline cancellations.

If you don't show up at the hotel, the entire booking amount will be deducted as no-show charges and no refunds will be applicable. For more details, please visit the Terms & Conditions.

Changes and modifications are not supported for online bookings once they are made as special rates are applicable.

For refunds, you will need to inform EDGE REWARDS customer service team at 1860-419-5555 or 1860-500-5555 within 48 hours from the time of cancellation done with the airline.

Post cancellation request is processed by the participating hotel partner, the applicable refunds will be credited in 15 working days.

In case you have opted for ‘Points Plus Pay’ facility while booking flight tickets, the cancellation fees will be deducted from the points and cash paid before processing the refund request.

While redeeming for hotel bookings at the ‘Recharges & Bookings’ platform, if EDGE REWARD Points get deducted and the redemption does not go through, the points will be credited into your account in 1 hour. If the products / services are being redeemed partially by points and cash, the amount paid by cash will be credited to your account in 7 working days.

Currently you will be able to recharge or pay mobile bills for only bank registered mobile numbers using your EDGE REWARD Points.

Yes, you can pay your mobile bills for postpaid numbers registered with Axis Bank.

Mobile recharge can be done only for a single bank registered mobile number at a time. In case you want to recharge multiple bank registered mobile numbers, you will have to action the redemption request for each mobile recharge separately.

Recharges and bill payments once done on ‘Recharges & Bookings’ store cannot be cancelled. All successful recharges and bill payments are final with no refund or exchanges permitted.

While redeeming for recharge or bill payment at the ‘Recharges and Bookings’ store, if EDGE REWARD Points get deducted and the redemption does not go through, the points will be credited into your account in 1 hour. If the products/ services are being redeemed partially by points and cash, the amount paid by cash will be credited to your account in 7 working days.

Movie tickets can be booked for multiple seats in one transaction at the ‘Recharges & Bookings’ store.

The email confirmation of your movie booking has to be printed and shown at the ticket counter to get a physical ticket, or the Booking Reference No./ Kiosk ID can be utilized to get the movie ticket at the counter.

Movie tickets once booked on ‘Recharges & Bookings’ store cannot be cancelled. Axis Bank and participating merchants do not permit exchanges or refunds after a ticket has been booked for lost, stolen, damaged or destroyed tickets.

Please review your booking details carefully before booking the tickets. Axis Bank and participating merchants will not be liable, in case you have filled in or selected wrong venue, movie, date, seats etc.

While redeeming for movie tickets at the ‘Recharges and Bookings’ store, if EDGE REWARD Points get deducted and the redemption does not go through, the points will be credited into your account in 1 hour. If the services are being redeemed partially by points and cash, the amount paid by cash will be credited to your account in 7 working days.

If you do not receive a confirmation email after submitting payment information, or if you experience an error message or service interruption after submitting payment information, please confirm the same from your booking history or by contacting Axis Bank Customer Service at 1860-419-5555 or 1860-500-5555.

No. Any claims with regards to refunds will not be entertained if there has been a no-show at the theatre.

Only one song can be redeemed and downloaded at a time. To redeem another song a new redemption request will have to be placed. Redemption cannot be done for an entire album in a single transaction.

No. Music cannot be redeemed with ‘Points Plus Pay’ facility on ‘Music Download’ platform.

Music once redeemed on ‘Music Download’ platform cannot be cancelled.

While redeeming for music at the ‘Music Download’ platform, if EDGE REWARD Points get deducted and the redemption does not go through, the points will be credited into your account in 1 hour.

If you do not receive a confirmation email after redeeming or if you experience an error message or service interruption after redeeming, please contact Axis Bank - Customer Service at 1860-419-5555 or 1860-500-5555.

Music cannot be downloaded on iPhone, iPads, or any other Apple devices through ‘Recharges & Bookings’ store. Please do not redeem your points to download music on Apple devices.

Once redeemed the download link will be available for only 15 minutes.

Instant e-vouchers will be delivered to your bank registered email id, instantly. In case of unforeseen situations it will be delivered maximum within 24hours. If the Instant e-vouchers are not delivered in your mail box within 24 hours, please call our Customer Service Number on 1860-419-5555 or 1860-500-5555.

Yes, Points earned on a particular day will expire after three years. E.g.: Points earned on 10th January 2013 will expire on 10th January 2016. Alternatively points will also expire in case of no transaction on the EDGE REWARDS Account in a period of 365 days.

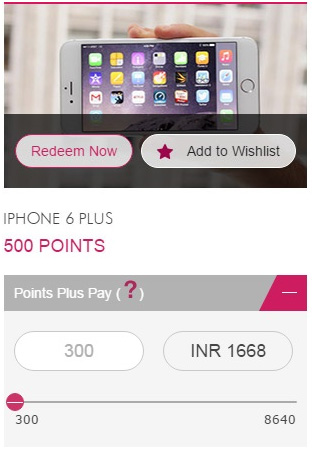

‘Points Plus Pay’ is a unique feature that enables you to redeem any reward you like, even if you don’t have the points for it! With this amazing functionality, all you need is a minimum of 300 points for any reward in the entire store! You can use the ‘Points Plus Pay’ feature to calculate how many points you are short of, and then calculate and pay its equivalent in money. What’s more, you can use any credit card to pay.

The ‘Points Plus Pay’ feature is extremely simple to use. Here is how it works.

- a) The Points Plus Pay feature is available right below

each reward. The box on the left indicates the points, and the box on the

right indicates the money required, in order to redeem this

particular reward. E.g.: In this case, you will need 500 points in

order to redeemthis reward.

- b) In case you do not have 500 points, you can use

slide the button back and forth to view various other

combinations of Points and Cash that you may use to redeem it.

E.g.: If you have 450 points, you can slide the button to the right,

until the box on the left shows 450 points. The box on the right

will automatically calculate and tell you the amount in rupees that

is left for you to pay.

Remember, you need to redeem a minimum of 300 points each time.

The basic structure of a family relationship is that all members of a family can link their individual customer IDs to one central Family ID. It is possible for both the customer IDs, and the Family ID to be part of the EDGE REWARDS program. In fact, to maximize your earnings from EDGE, we highly recommend that individual members Customer IDs are linked to a Family ID! The advantage of linking Customer ID’s is that the points to all individual family members are awarded on the basis of Average monthly Balance of all the accounts in the family relationship! So even if you personally have not been able to maintain an average balance of Rs.25,000, as long as your Family balance is above Rs.5,00,000, you will still receive points for your transactions.

Points are awarded to the person within the family who carries out the transaction. It will reflect against that person’s individual customer ID. However, if a new member is added to the family, the points for that will go to the Primary family member in the family relationship. The points for all members of a family will be calculated on the basis of the balance in all the accounts of that family ID.

Points are awarded to the person within the family who carries out the transaction. It will reflect against that person’s individual customer ID. However, if a new member is added to the family, the points for that will go to the primary family member in the family relationship. The points for all members of a family will be calculated on the basis of the balance in all the accounts of that family ID.

No, there are no additional charges for transferring points on EDGE REWARDS .

EDGE REWARDS is not liable or responsible for any cancellation of transaction in case of points are transferred wrongly to an incorrect Customer ID. EDGE REWARD Points successfully transferred cannot be credited to your EDGE REWARDS account.

The EDGE REWARDS program is designed in such a manner that the eligibility criteria is very simple to understand. To be eligible to earn points you need to have one or more of the below products, and be a customer of good standing with Axis Bank. Remember, if you have more than one of the products listed below, you’ll be earning points on all of them.

To view our vast array of earning options, click here, or read our Terms and Conditions to know more.

Eligible Savings Accounts

- a. A Priority Savings Account with a minimum average balance of Rs.25,000 per month

- b. An NRI Savings Account with a minimum average balance of Rs.25,000 per month

- c. Burgundy Account

- d. Inaam Account

Eligible Current Accounts

- a. Normal Current Account (CANOR)

- b. Local Current Account (CALCA)

- c. Business Advantage Current Account (CAADV)

- d. Business Global Current Account (CAGBL)

- e. Business Privilege Current Account (CABPL)

- f. Business Classic Current Account (CABCA)

- g. Business Select Current Account (CASEL)

- h. Channel One Current Account (CACH1)

- i. Club 50 Current Account (CAC50)

- j. Current Account Pharmaceutical (CAPHM)

- k. Current Account Pharmacist Druggist Chemist (CAPDC)

Eligible Credit Cards

- a. My Business Credit Card

- b. VISA Silver Corporate Card Individual Liability

- c. VISA Silver Corporate - J&S

- d. VISA Gold Corporate Card Individual Liability

- e. VISA Gold Corporate Card - J&S

- f. Easy Gold Card Salaried

- g. Signature Card with Lifestyle Benefits

- h. Signature Card with Flexible Spending Limit

- i. Wealth Signature Credit Card with Travel Benefits

- j. Gold Business Credit Card

- k. Easy Gold Credit Card - Self Employed

- l. Infinite Reserve Credit Card

- m. VISA Platinum Credit Card

- n. Insta Easy Credit Card

- o. VISA Secured Platinum Card

- p. My Zone Credit Card

- q. VISA Gold Card

- r. VISA Gold Std Card

- s. VISA Gold Plus Card

- t. Secured Gold Card

- u. VISA Silver Card

- v. VISA Silver Plus Card

- w. VISA Classic Silver Card

- x. Secured Silver Card

- y. VISA Platinum Corporate Card - CCIL

- z. Titanium Credit Card

- aa. My Choice Credit Card

- ab. My Choice Image Credit Card

- ac. My Wings Credit Card

- ad. Signature Defence Card

- ae. Pride Platinum Defence Card

- af. Privilege Credit Card

- ag. Neo Card

- ah. MasterCard CCIL Credit Card

- ai. Shopping Reward Credit Card

- aj. Select Credit Card

- ak. Buzz Credit Card

- al. Pride Platinum Credit Card

- am. Pride Signature Credit Card

- an. Freecharge Credit Card

- ao. Magnus Credit Card

Eligible Debit Cards

- a. Priority Platinum Debit Card (MasterCard/Visa)

- b. Instant Welcome Kit Card For Priority A/Cs

- c. Platinum Chip Card

- d. Gold Debit Card

- e. Business Titanium Rewards Card

- f. Ladies First Card

- g. MasterCard Gold Plus Debit Card

- h. Wealth Card

- i. Privee Card

- j. Titanium Rewards Card

- k. Domestic Debit Card (NRI)

- l. NRI International Debit

- m. Titanium Prime Debit Card

- n. Titanium Prime Plus Debit Card

- o. Titanium Domestic Card

- p. Smart Privilege Card

- q. VISA Classic International Card (Inaam Account)

- r. VISA Classic Domestic Card (Inaam Account)

- s. Burgundy World Debit Card

- t. Online Rewards Debit Card

- u. Secure + Debit Card (Visa/MasterCard)

- v. Business Platinum Card

- w. Display Debit Card

- x. Mariner’s Debit Card

- y. Axis Active Debit Card

- z. Priority Platinum Chip Card

- aa. RuPay Priority Banking Card

- ab. Rewards+ Visa Debit Card

- ac. Value+ Debit Card

EDGE REWARDS is the only Banking rewards program in the country that offers you over 70 ways in which to earn rewards. With Axis Bank and EDGE REWARDS , you can start earning with the smallest of transactions, requests and actions.

With EDGE you can

- Earn on products, such as cards, accounts

- Earn on transactions, such a credits, spends and download

- Earn on upgrades and additions, such as introducing a new family member or upgrading your card

- Earn on Partner Brands, such as bonus points for using your Card with some brands

Click here to see how.

For Priority Savings Accounts, Burgundy Accounts and NRI Accounts, the points are calculated on the basis of the average monthly balance (AMB) maintained in all the accounts under your Customer ID.

If AMB is between Rs. 25,000 to Rs. 1,00,000 you will earn ‘x’ reward points

If AMB is between Rs. 1,00,000 to Rs. 5,00,000 you will earn ‘2x’ reward points

If AMB is greater than Rs. 5,00,000 you will earn ‘3x’ reward points

Members eligible for the Family Banking will earn points on the basis of the family banking relationship maintained with the bank.

For Example: If the total family relationship value is greater than Rs. 5,00,000, and the AMB balance maintained by the same individual is between Rs. 25,000 to Rs. 1,00,000 then the family members will earn 3x points due to his family relationship value.

Click here to know more about Average Monthly Balance calculation.

NRI Savings account customers can earn EDGE REWARD Points on all inward remittance transactions as given below:

| S.No | Value of Inward Remittance converted to INR | Points |

|---|---|---|

| 1 | Less than or equivalent to INR 2 Lakhs | 80 Points/Lakh |

| 2 | Greater than INR 2 lakhs to INR 5 Lakhs | 100 Points/Lakh |

| 3 | Greater than INR 5 Lakhs to INR 10 Lakhs | 120 Points/Lakh |

| 4 | Greater than INR 10 Lakhs | 1,000 Points/Transaction |

For Example: If a non-resident customer remits an amount of INR 1.80 Lakh, the customer will get 80 EDGE REWARD Points and not 160 EDGE REWARD Points since the threshold of 2 lakhs is not achieved

You can earn minimum 80 EDGE REWARD Points and maximum 1,000 EDGE REWARD Points per month.

What is the minimum and maximum transaction amount to earn EDGE REWARD Points on inward remittances?

You can earn EDGE REWARD Points with any inward remittances credited to your NRI Savings Account.

You can remit money into India through any of the online (Internet Banking-REMITMONEY) and offline modes (through branch banking channel)*

*Visit https://www.axisbank.com/nri/send-money-to-india to know more, on the ways to remit money to India.

There are many ways in which you can earn bonus points with EDGE REWARDS . Here’s how you can earn bonus points and speed up your earnings

- Our Partner Brands give you bonus points from time to time.

- Special Axis Bank products like Rewards Cards and Online Rewards cards also offer bonus points on specific transactions.

Click here to view current offers and the current point structure.

Click here to check the Earn Rules.

Click here to shop for your favourite brand gift cards.

Axis Bank and EDGE REWARDS provides you multiple ways to view and access your points.

- Internet Banking – You can view and use certain functionalities of the EDGE REWARDS site such as view, transactions history, etc. through your Internet banking.

- Mobile Banking – Axis Bank brings you EDGE REWARDS on the mobile. View your points history on the go, and even access specific functions like download a points statement.

- The EDGE REWARDS site - www.edgerewards.axisbank.co.in, our site is designed to help you utilize the EDGE REWARDS program to the fullest. Register on this site to view not only how many points you and your family have, but to see our suggestions on how you can earn faster (with our ‘Earn Faster With’ section), and to view 'Specially for You' from our store! Most of all, it is necessary to register on this site to redeem, so this is the easiest way in which to access your points and rewards.

The fastest way to earn points on EDGE REWARDS is to view the ‘Earn Faster With’ options provided on the EDGE REWARDS site. These options given to you are based specifically on how many points you have earned previously, your earning rate and a number of other factors.

We do our best to have EDGE REWARD Points credited to all our customers in an accurate and timely manner. We credit points to all our EDGE REWARDS customers on the 27th of each month. These points are reflected in the account statements of the relevant months.

You can log in to internet banking, mobile app, https://edgerewards.axisbank.co.in to view your current points balance, as well as the history of transactions where points were earned / redeemed by you. In case you still feel an error may have occurred, please feel free to write to us at edgerewards@axisbank.co.in, or call us 1860-419-5555, and we will do our best to resolve your problem.

You can earn points on any or all of the below types of relationships, products and even transactions!

- a. A Priority Savings Account with a minimum average balance of Rs.25,000 per month, or a Burgundy Account.

- b. A Credit or Debit Card

- c. Current Account

- d. Forex Transactions

To view our vast array of earning options, click here.

At EDGE REWARDS , we understand that the number of banking transactions you may carry out in a month could be limited. This is why we’ve built additional options for you to earn, which aren’t to do with banking. In addition to your banking transactions, we also provide the below options for you to earn.

- Partner Deals – Some of our partner brands give you additional earning options with bonus points if you purchase something from them using a card. For the complete list of Partner Brand stores and their offers, click here.

No, as a Burgundy customer, you have an exclusive relationship with Axis Bank, and you will earn points for all your transactions irrespective of the balances you maintain in your savings account. Click here for a full list of transactions on which you can earn points.

The AMB or Average Monthly Balance on which the points will be awarded to you will be on the basis of the month prior to the month on which you are carrying out the transaction. For example, in the month of May 2015, if you carry out any transactions that will earn you points, these points will be awarded on the basis of your balance in the month of April 2015.

You can earn EDGE REWARD Points on Outward Remittance through internet banking or branch, on loading and re-loading of Travel Currency Card and on your Travel Currency Card spends. To know more details kindly visit ‘How Can I Earn’ page on EDGE REWARDS website.

Only those Corporate Card members where the payment is done by the individual and not the company are eligible to earn EDGE REWARD Points on their Axis Bank Credit card. Corporate cards where the liability of payment is with the corporate will not earn any EDGE REWARD Points.

As an NRI Customer, as long as you hold one of the below accounts, or carry out one of the below transactions, you will automatically earn points.

You can earn on

- a. A Savings Account with a minimum average monthly balance of Rs.25,000 per month, or a Burgundy Account, or an Inaam Account

- b. A Credit or Debit Card

- c. Current account

- d. A Family Relationship

- e. Forex Transactions

- f. Trade reported per day

To view our vast array of earning options, click here.

If you have a NRI – PIS account with Axis Bank, you can earn maximum 20 points for the trade date. Points earned through eligible earn actions will be credited to the EDGE REWARDS account by the 20th of the following month.

EDGE REWARDS Points for NRI PIS Transactions are applicable only on scheme codes NREPI and NROPI.

Points are calculated by rounding down the transaction value to the nearest integer and as per the criteria set for each Axis Bank product. For example, if the transaction value is Rs. 259 it will be rounded off down to the nearest integer Rs. 200 for purpose of calculating points.

Purchases on add-on Credit Cards will earn EDGE REWARD Points. These points will be credited to the primary EDGE REWARDS relationship holder's account. Only the primary account holder can redeem these points.

The simplest way to do this is to visit our ‘How Can I Earn’ section in case you have any queries. This section tells you what products / services / actions you can take to earn points, and how many points you will earn as well.

No. You will earn EDGE REWARD Points on loading of Travel Currency Card only if it is paid through Savings Account.

- a. If the spends on Travel Currency Card are done in any other currency other than USD, it will be first converted to USD as per the prevailing exchange rate on 1st of that month ( Month in which the transaction has been done ) and then EDGE REWARD Points will be calculated.

- b. Points will be credited on a cumulative basis for all transactions done in the month.

*E.g.: Customer has spent a cumulative of EURO 300 in January, 2014. The exchange rate prevailing on 1st January, 2014 is 1 EURO = USD 1.38. The equivalent USD amount now becomes USD 412.73. Basis the earn rule as mentioned above the customer account will be credited with 164 EDGE REWARD Points for USD 412.73.

You are eligible to earn 5 times the reward points every time you shop or dine with your Titanium Rewards Debit Card or Rewards+ Debit Cards. Card holders need to use their valid Titanium Rewards Debit Card or Rewards+ Debit Card as the mode of payment to enjoy 5x EDGE REWARD Points for every Rs. 200 spent on dining or shopping at an apparel store

No, there is 5% cash back for movie transactions, using your Titanium Rewards Debit Card. You will not be entitled to earn EDGE REWARD Points while availing the cash back on your movie spends.

Yes, you will continue to earn 1 reward point on domestic and international spends, for every Rs. 200 spent.

Yes, you will earn 2X points for every Rs. 200 spent on utility bills paid online with your Online Rewards Debit Card.

No. You will earn points on the Current Account transactions as specified in the earn rules on the website; however points will not be provided for Current Account Debit Card transactions. For example – If a customer has Business Platinum Debit Card and Club 50 Current Account, then the customer is eligible to earn points, however the customer will earn points only on the Club 50 Current Account and not on the Business Platinum Debit card.

You can earn 500 EDGE REWARD Points in a week (subject to timely change) based on 70, 000 steps you clock in the GOQii Pedometer.

You would also earn EDGE REWARD Points for the contactless payment done using the POS Terminal.

- a. Step 1: Find the Barcode in the Active Box.

- b. Step 2: Tap on the camera icon in the Active section of Axis Mobile.

- c. Step 3: Select ‘Take Photo or Video’, & place the barcode below the camera, focus & then click. Retake the image if it is blurred.

- d. Step 4: Tap on ‘Use image’ and the barcode would be decoded.

- e. Step 5: Check if the no. populated matches with no. printed in the barcode or manually enter the barcode number.

- f. Step 6: Tap ‘Proceed’ to continue.

To Activate your Active Band, follow the below steps:

Wear your Active Band for your daily activities. Sync the band once daily or atleast once in 3 days with Goqii App. You would automatically avail loyalty points if you fulfil the weekly target of 70, 000 steps, starting from Monday and ending on Sunday.

EDGE REWARDS program is Axis Bank’s bank- wide loyalty program for all Axis Bank customers. Being a part of this program means that you earn EDGE REWARD Points on your everyday banking activities, which you can then spend on over 500 exciting rewards spread across various categories.

The EDGE REWARDS program came into effect 5th March, 2013 onwards with rewards for credit card, debit card and savings account customers.

The program has been extended to the Axis Bank NRI customers with effect from 1st December 2013, to Forex customers & Travel.

Currency card holders with effect from 1st Jan, 2014, select Current Account customers with effect from 5th November, 2014

Effective 10th November 2014, EDGE REWARDS Program is now available to all Axis bank customers. For new eligibility and earn criteria please click here.

You don’t need to register for EDGE REWARDS program separately. As long as you fulfill the eligibility criteria listed above, you will be able to participate in the program

To view our vast array of earning options, click here.

Effective 10th September 2022, redemption fee will be levied to your Axis Bank Cards/Saving accounts on redemption of EDGE REWARD Points for Reward Store (Physical Products/ e-Vouchers), RTR Offline and IOCL transactions. For more information, please refer to the redemption Fee FAQ's.

To change your Bank Registered email ID, please visit your nearest Axis Bank branch or ATM.

In case the status of your Axis Bank relationship changes – upgrades / downgrades / account closure & opening – this will impact your EDGE REWARDS relationship as well. The points will be calculated with respect to the changed status from the date of change.

You can redeem points from our carefully put together Rewards Store & even at a Partner Brand's outlets.

At EDGE REWARDS , we try to ensure that you can redeem your points for the rewards you desire. With this in mind, we’ve created ‘Points Plus Pay’, a feature that allows you to pay the equivalent of points in money. Just input the no. of points you wish to redeem (you need a minimum of 300) and 'Points PlusPay’ calculates how much you need to pay as the balance. So now you can get the reward of your choice, even without the points!

You can start redeeming your points as soon as you reach a minimum threshold of 300 points.

There are 3 ways to redeem:

- a. Internet Banking: Log on to Internet Banking with your Customer ID & Password. Click on EDGE REWARDS on the Account Summary page. Accept the Terms & Conditions and then click ‘Redeem Now’ to view the Rewards Store. Choose the reward of your choice from various categories, add to basket & confirm the redemption. After accepting the Terms and Conditions for the first time on Internet banking, you can easily redeem your points the next time you log in to EDGE REWARDS through Axis bank website using this feature.

- b. Axis Mobile : Download the Axis Mobile. Click on ‘Rewards’ tab from the Menu to view your points balance. Go to ‘Redeem Now’ section and click on 'Rewards Store'. Choose the rewards of your choice from different categories, add to basket and confirm the redemption.

- c. Contact Center: You can redeem your points for products displayed at the ‘Reward Store’ through the contact center by calling 1860-419-5555 or 1860-500-5555.

Points earned on a particular day will expire after three years. For E.g.: Points earned on 10th January 2013 will expire on 10th January 2016.

Points will also expire in case there is no account activity over a period of 365 days. E.g.: If you have not done any earn transactions, redemptions or have not logged in to your account for a period of 365 days from your last transaction, your points will expire on the 366th day.

You can use your points at a Partner brand's store in the simplest way possible - in lieu of money!Just use Debit or Credit Card to pay.

To redeem your points at stores, you will need to visit the website of our partners, and check out the details of our points being accepted at their stores. You also need to make a minimum purchase of Rs.100 to qualify for points usage. Any Terms & Conditions mentioned on our partner brand's websites are in addition to the Terms & Conditions of the EDGE REWARDS Program.

Yes, if you have enough points, you can choose to redeem them for multiple rewards at the same time. All you need is a minimum of 300 points per reward to check-out your cart.

e-Vouchers are mailed only to the registered email address as provided in your bank/ card account with the bank. Please visit the bank branch to update your registered email address.

All instant e-Vouchers will be sent to your registered email ID. The email will contain 16 digit code and in a few cases 6 digit pin which you will need to present at the payment counter at the retail stores.

To use instant e-Vouchers for online shopping, key in the 16 digit code along with the pin wherever applicable at the payment step.

For detailed terms and conditions and steps to redeem, refer the individual emails received with instant e-Voucher codes.

Yes, you can now redeem your EDGE REWARD Points at select merchant outlets. Instead of settling your bill with cash, you can make purchases utilizing your EDGE REWARD Points balance. List of participating Merchant outlets are updated on the EDGE REWARDS website.

In case you are facing a problem with redeeming points with Partner brands, you can call our Customer Service Number at 1860-419-5555 or 1860-500-5555 or reach us at axisbank.com/support to get further help.

No, points once expired cannot be re-credited.

Credit Card customers with minimum 300 EDGE REWARD Points balance can redeem their points at select Merchant outlets. For the complete list of Credit Cards on EDGE REWARDS Program, please visit Terms & Conditions section at edgerewards.axisbank.co.in

There are two ways to redeem your points at POS,

-

A. Using Points only, when your invoice value is lesser than the points in your card, you can pay using the points. When you choose this option, Re 1/- will be deducted from the invoice value and the balance will be paid by points.

For e.g.: A bill value of Rs. 100 at a partner store, 495 EDGE REWARD Points worth Rs. 99/- will be debited from the point balance and Rs. 1/- will be debited using the eligible Axis Bank credit card by the customer. Customer enters Card PIN to complete the transaction

-

B. Points + Pay, when your invoice value is higher than the reward points in your card, you can redeem all the reward points and the balance will be paid using the card.

For e.g.: For a bill value of Rs. 5000 at a partner store, if you have 4,000 EDGE REWARD Points worth Rs. 800/- all reward points will be debited from the point balance and Rs. 4200/- will be debited using the eligible Axis Bank credit card by the customer. Customer enters Card PIN to complete the transaction

In Option A, why is Re 1 debited from my card even when I have sufficient points?

- This is a process by the bank to enable 2 factor authentication, to ensure that the transaction is safe and secure

- Rupee 1 is debited from your invoice value and the customer is not charged additional or extra

- It will not be reversed since Rupee 1 is debited from your invoice value and the customer is not charged additional or extra.

Rupee 1/ debited from my card, is it part of my invoice or am I charged additional?

Will the rupee 1 debited from my card be reversed?

No,Debit Card customers cannot redeem their EDGE REWARD Points at Merchant outlets.

All products available in the Merchant outlet can be redeemed for EDGE REWARD Points, however the minimum bill value should be greater than or equal to Rs.100.

You can get the details of the EDGE REWARD Points required to buy a product from front desk executive of the participating merchant outlet.

Total number of points redeemed is not available on the customer copy, however Axis Bank sends an SMS and an email to their customers on any redemption done at the merchant outlet using their EDGE REWARD Points. You can check the total points utilized for the said redemption in the SMS trigger and the email sent to your bank registered email ID and mobile number.

Redemption at Merchant outlet can be done on swipe as well as chip enabled cards. On the chip enabled cards the redemption is done without asking for the pin number. The cashier will use the chip and pin enabled card as regular swipe cards.

Sometimes due to various blocks appearing on your Bank account, the transaction is not processed, therefore we request you to call our phone banking team on 1860-419-5555 or 1860-500-5555 to understand the reason for the same.

This situation may occur sometimes due to a technical issue while transacting at the merchant outlet. A credit note or gift voucher of equivalent value will be issued by the respective merchant outlet.

Cancellation of order once placed at merchant outlet would depend on the Terms & Conditions of the Merchant outlet for which EDGE REWARD Points have been utilised. Axis Bank will not be in a position to cancel the order or entertain any cancellation request for orders placed at the merchant outlet using EDGE REWARD Points.

If you wish to cancel the purchases made at the Merchant outlet, the corresponding refund will be governed by the terms and conditions of the participating Merchant outlet. For all cancelled transactions, EDGE REWARD Points will not be credited back, a credit note or gift voucher of equivalent value will be issued by the respective merchant outlet.

Yes, redemption at merchant outlets can be done partially using points and cash. If you have insufficient EDGE REWARD Points to purchase the product at a merchant outlet, you can use your available points and make the balance payment using Credit Card / Debit Card /cash.

The points would be credited for redemption within 5 working days of completion of current week, that’s is starting from Monday and ending on Sunday.

In case you are facing a technical difficulty while logging into the site you can call our Customer Service Number at 1860-419-5555 or 1860-500-5555 or reach us at axisbank.com/support to get further help.

You can also login to the EDGE REWARDS Program in ways other than the website.

- a. Internet Banking – Login using your Internet Banking registration details

- b. Mobile Banking – Use Axis Mobile to access the EDGE REWARDS Program.

To find a reward you love, you can browse our Rewards Store section of the site. You can visit a section that interests you, and click on ‘See More’. This opens up more rewards for you to view within the same category. As you browse, add items to ‘My Wishlist’, so you can view them all together before making your choice.

‘ My Wishlist’ is a feature that compiles all the rewards that you have shortlisted. Adding a reward to ‘My Wishlist’ as you browse is a smart thing to do, because you can view all the shortlisted rewards in one go later, helping you choose the right reward for you. ‘My Wishlist’ remains intact even if you sign-out, so you can always come back and choose from ‘My Wishlist’ later, instead of having to browse and select all over again.

There are two ways to add a reward to ‘ My Wishlist’

- a) Bring your mouse on top of the reward and click on the ‘ Add to Wishlist’ option. The star will turn golden once you click it.

- b) Click on a product to view its details. Then click on The

‘Add to Wishlist’ option.

Visit My Points >My Transaction History to view your past transactions on EDGE REWARDS . You can view both points you’ve earned, as well as rewards you’ve redeemed in the past year.

The new EDGE REWARDS program site comes to you with a host of features that make the site easier to use, fun to login to, and is also personalized for you! It has

- a. Access through Mobile application

- b. Hand-picked Rewards

- c. Gifting options like gift wrapping and personal messages

- d. Status of your reward dispatch and delivery

- e. A complete history of your points earnings

- f. Option to download your transactions for the last one year

- g. An easy to browse Rewards Store with ‘My Wishlist’, sorting options, etc

The new mobile app is great way to use the EDGE REWARDS Program. Through this app, you can use all the functionalities on the site, as you would on a laptop or computer.

While redeeming your points on the EDGE REWARDS website, the ‘My Cart’ section is where all your rewards you want redeemed will end up. In order to complete the process, you need to check-out your cart. You can even save items to your cart, and come back for them later. In 'My Cart' you will also be provided with an option to get your reward gift wrapped. The gift wrap will be done at an additional cost of 30 points. You can also personalize your gift by adding a simple message to it.

You can simply receive a new password by clicking on the Forgot Password link and entering your customer ID. A new password will be sent to your registered email address.

A ‘REDEMPTION FEE’ is a service charge that will be applied to the customer’s Credit Card/Debit Card/ Savings Account on successful redemption of a customer’s EDGE REWARD Points.

Under the Redemption fee policy update, any Cardholder who redeems any product, voucher (or a combination of the two) from the EDGE REWARD website for services such as rewards store or redeems his/her points/miles at Point of Sale (POS) partner stores and on Travel EDGE will be charged a nominal redemption fee as per the fee structure shared.

Redemption Fee will be levied to your Axis Bank Credit Cards/Saving accounts on successful delivery of redemptions of EDGE REWARD Points/Miles for Reward Store (Physical Products/e-Vouchers), at Point of Sale (POS) partner store and Travel EDGE using EDGE REWARD Points/Miles.

Credit Cards: Redemption fee will be levied for customers with open credit Credit card account on their credit card as per below table.

| Redemption Channel | Redemption Fee |

|---|---|

| Edge Rewards Portal, Travel Edge (Flights , Hotels & Experiences) & RTR Offline at POS | INR 99 plus GST |

| Miles Transfer | INR 199 plus GST |

For rest of the customers Debit Card/Savings Account/Current Account: Redemption fee will be levied on SA/CA

| Number of EDGE REWARD Points Redeemed | Redemption Fee |

|---|---|

| 300 points - 10,000 points | INR 49 plus GST |

| 10,001 points and above | INR 99 plus GST |

However, if in a particular order reference number, there are multiple products/vouchers and even if 1 product/voucher is delivered, then the redemption fee will be charged.

Redemption fee will levied on Savings account/Current Accounts only if customer doesn’t hold any Axis Bank credit card irrespective of the redemption channel. In case customer holds a Axis Credit card , redemption fee will be applicable as per redemption fee schedule.

Effective 1st April 2023,earning of EDGE REWARD Points have been discontinued for opening of Axis Direct account and trading via the same. Earning of points on other earn rules will remain independent of this.

Effective 1st April 2023,earning of EDGE REWARD Points have been discontinued for opening of Axis Direct account and trading via the same and therefore, no EDGE REWARD Points can be earned on the same.

You cannot earn any points on any Axis Direct transactions as earning of EDGE REWARD Points have been discontinued for opening of Axis Direct account and trading via the same.

Earning of EDGE REWARD Points have been discontinued for opening of Axis Direct account and trading via the same and therefore, irrespective of the amount, EDGE REWARD Points cannot be earned on the same.

Axis Direct transaction done on or before 31st March 2023 will be eligible for earning EDGE REWARD Points.

Orders or investment in IPO/NCD/Bonds, Futures & Options & MF transactions.

EDGE REWARD Points have been discontinued for Axis Direct account opening and

transactions mentioned below, for NRI customers:

| Transaction Type | AMB between Rs.25,000 to Rs.1,00,000 | AMB between Rs.1,00,000 to Rs.5,00,000 | AMB greater than Rs.5,00,000 | Limit per financial year i.e. April – March |

|---|---|---|---|---|

| Opening of Axis Direct Account | 400 points | 800 points | 1200 points | One Time |

EDGE REWARD Points will be discontinued for Axis Direct account opening and transactions mentioned below, for Burgundy Private & Burgundy customers:

| Transaction Type | Points to be earned | Limit per financial year i.e. April – March |

|---|---|---|

| Opening of Axis Direct Account | 1200 points | One Time |

The above is applicable for both NRI and Domestic Burgundy customers.

EDGE REWARD Points will be discontinued for the Axis Direct account opening and transactions mentioned below, for all customers:

| Earn Rule | Description | Rule |

|---|---|---|

| Earn points when you start your first Equity SIP | Min. Rs.2000 p.m., for min. 36 months | 250 points |

| Earn points when you place your first trade | Only through Axis Direct Mobile App | 250 points |

Points earned through eligible earns before 1st April 2023 will be credited to your EDGE REWARD account by the 20th of the following month. You can view these points under the ‘Transaction History > Earn Summary’ Tab on the program website or call the Axis Bank call center.

Yes. Points earned on a particular day will expire after three years. E.g.: Points earned on 10th January 2020 will expire on 10th January 2023. Alternatively points will also expire in case of no transaction on the EDGE REWARD account in a period of 365 days.

For any queries on EDGE REWARD Points, please call our Customer Service number at 1860-419-5555 or 1860-500-5555 (local charges will be applicable) or reach out to your relationship manager. Burgundy Private toll-free number: 1800-210-8888. Burgundy Exclusive toll-free number: 1800 419 0065 & Burgundy Exclusive Email ID premium.experience@axisbank.com NRI customers can connect with us on our 24x7 NRI Phone Banking numbers available on axisbank.com/pbnri

SMS Based Redemption is an instant reward redemption option that allows the credit cardholder to redeem EDGE REWARD Points / EDGE Miles against the transactions made through eligible Credit Card. These transactions can be done at select merchants or designated merchant categories e.g., travel, retail utilities etc., using the eligible Axis Bank Credit Card.

Below are the considerations applicable for SMS Based Redemption:

- All transactions made using select Axis Bank Credit Cards with designated partner merchants, will be considered as eligible transactions.

- When an eligible transaction is made, credit cardholder will receive an SMS on his / her registered mobile number with a link to redeem EDGE REWARD Points / EDGE Miles for the transaction. For eligible transactions credit cardholders will receive an SMS once per day.

- Redemption link is valid for 24 hours post performing the eligible transaction.

- By clicking on the link, cardholder will be redirected to the SMS Based Redemption screen, where they will be able to select the amount up to which they would like to redeem with available EDGE REWARD Points / EDGE Miles The cardholder can choose to redeem either a partial amount of the transaction, or the full amount, basis the cardholder’s available EDGE REWARDs / Miles Balance. The Axis Bank microsite would show the cardholder’s available EDGE REWARD Points / EDGE Miles, transaction amount and equivalent EDGE REWARD Points / EDGE Miles to be deducted against the amount of transaction.

- Once the redemption amount is selected, cardholder may click on the “Redeem Now” button. Successful redemption pop-up will be visible on mobile screen on completion of redemption journey and Axis Bank EDGE REWARD Points / EDGE Miles will be debited from the EDGE REWARDS Account.

The cardholder will receive only one SMS in a day for the eligible transaction done on eligible credit card.

| Category | Merchant | MCC | Value of 1 EDGE REWARD Points/EDGE Miles in INR for SMS Based Redemption | |||

|---|---|---|---|---|---|---|

| Axis Bank REWARDS Credit Card (EDGE REWARD Points) | IndianOil Axis Bank Premium Credit Card (EDGE Miles) | Axis Bank HORIZON Credit Card (EDGE Miles) | Axis Bank OLYMPUS Credit Card (EDGE Miles) | |||

| Travel | MakeMyTrip | 4722 & 4511 | 0.15 | 0.25 | 1 | 1 |

| EaseMyTrip | 0.15 | 0.25 | 1 | 1 | ||

| Travel EDGE Portal | 0.15 | 0.25 | 1 | 1 | ||

| Indigo | 0.15 | 0.25 | 1 | 1 | ||

| Cleartrip | 0.15 | 0.25 | 1 | 1 | ||

| Go Ibibo | 0.15 | 0.25 | 1 | 1 | ||

| Yatra | 0.15 | 0.25 | 1 | 1 | ||

| Utility | Vodafone | 4814 | 0.18 | 0.3 | 0.65 | 1 |

| Airtel | 4814, 4900 & 7832 | 0.18 | 0.3 | 0.65 | 1 | |

| Jio | 4814, 4900 & 7832 | 0.18 | 0.3 | 0.65 | 1 | |

| BookMyShow | 4814 & 7832 | 0.18 | 0.3 | 0.65 | 1 | |

| Retail | Shopper Stop | 5311, 5399, 5651 | 0.18 | 0.3 | 0.65 | 1 |

| Westside | 5699, 5944 & 5999 | 0.18 | 0.3 | 0.65 | 1 | |

| Fuel | Indian Oil | 5541 | 0.15 | 1 | 0.65 | 1 |

| Dining | Dining merchants | 5811, 5812, 5813 & 5814 | 0.15 | 0.25 | 0.65 | 1 |

| Grocery & Medical | Grocery & medical merchants | 8062, 5912 & 5411 | 0.15 | 0.25 | 0.65 | 1 |

| Others | PayPal, Points for People, Old Sanawarian Society, Akshaya Patra foundation & PM Cares fund. | Select MCCs (Excl. above) | 0.12 | 0.2 | 0.45 | 1 |

Please note:

IKEA Card holders are eligible for redemption at IKEA stores (including online) at conversion of 1 point = INR 0.2

SMS Based Redemption service is valid for 24 hours only post performing the eligible transaction, but it is recommended to redeem when the SMS is received.

This offer is applicable on Axis Bank REWARDS Credit Card, IndianOil Axis Bank Premium Credit Card, Axis Bank HORIZON Credit Card and Axis Bank OLYMPUS Credit Card. The aforementioned credit card should be in active status to be eligible for SMS Based Redemption.

If the EDGE REWARD Points / EDGE Miles redemption is successful, the amount of the transaction redeemed will be shown in unbilled section of the Credit Card within 4 working days.

Potential explanation for not receiving the SMS redemption link post-transaction could be one of several factors including but not limited to the non-availability of EDGE REWARD Points / EDGE Miles at the time of the transaction, ineligibility of your credit card / transaction for redemption, or potential issues with cardholder's mobile network connectivity.

Once the redemption request has been submitted, the redemption cannot be reversed, cancelled, or changed and the EDGE REWARD Points / EDGE Miles used in the redemption cannot be transferred back to available EDGE REWARD Points / EDGE Miles balance.

Cardholder would get the SMS triggered directly from the Bank to their registered mobile number.

The cardholder will get full or partial EDGE REWARD Points / EDGE Miles redemption option based on the below mentioned grid.

| Cards | Merchants / Merchant Category | Transaction Amount (in INR) | Redemption Type |

|---|---|---|---|

| Axis Bank REWARDS Credit Card | Travel / Fuel / Dining / Grocery & Medical | <=45 | No Redemption |

| >45 and <=2 Lakhs | Partial Redemption* | ||

| >2 Lakhs | Partial Redemption* | ||

| Utility / Retail | <=54 | No Redemption | |

| >54 and <=2 Lakhs | Partial Redemption* | ||

| >2 Lakhs | Partial Redemption* | ||

| PayPal, Points for People, Old Sanawarian Society, Akshaya Patra foundation & PM Cares fund | <=36 | No Redemption | |

| >36 and <=2 Lakhs | Partial Redemption* | ||

| >2 Lakhs | Partial Redemption* | ||

| IndianOil Axis Bank Premium Credit Card | Travel / Dining / Grocery & Medical | <=75 | No Redemption |

| >75 and <=2 Lakhs | Partial Redemption* | ||

| >2 Lakhs | Partial Redemption* | ||

| Utility / Retail | <=90 | No Redemption | |

| >90 and <=2 Lakhs | Partial Redemption* | ||

| >2 Lakhs | Partial Redemption* | ||

| Fuel | <=300 | No Redemption | |

| >300 and <=2 Lakhs | Partial Redemption* | ||

| >2 Lakhs | Partial Redemption* | ||

| PayPal, Points for People, Old Sanawarian Society, Akshaya Patra foundation & PM Cares fund. | <=60 | No Redemption | |

| >60 and <=2 Lakhs | Partial Redemption* | ||

| >2 Lakhs | Partial Redemption* | ||

| Axis Bank HORIZON Credit Card | Utility / Retail / Fuel / Dining / Grocery & Medical | <=195 | No Redemption |

| >195 and <=2 Lakhs | Partial Redemption* | ||

| >2 Lakhs | Partial Redemption* | ||

| PayPal, Points for People, Old Sanawarian Society, Akshaya Patra foundation & PM Cares fund. | <=135 | No Redemption | |

| >135 and <=2 Lakhs | Partial Redemption* | ||

| >2 Lakhs | Partial Redemption* | ||

| Axis Bank HORIZON Credit Card & Axis Bank OLYMPUS Credit Card | Travel | <=300 | No Redemption |

| >300 and <=7,500 | Full Redemption | ||

| >7500 and <=2 Lakhs | Partial Redemption* | ||

| >2 Lakhs | Partial Redemption* | ||

| Axis Bank OLYMPUS Credit Card | Utility /Retail /Fuel | <=300 | No Redemption |

| >300 and <=1 Lakhs | Full Redemption | ||

| >1 Lakhs and <=2 Lakhs | Partial Redemption* | ||

| >2 Lakhs | Partial Redemption* | ||

| Dining /Grocery & Medical / PayPal, Points for People, Old Sanawarian Society, Akshaya Patra foundation & PM Cares fund. | <=300 | No Redemption | |

| >300 and <=2 Lakhs | Partial Redemption* | ||

| >2 Lakhs | Partial Redemption* | ||

| IKEA** | IKEA | <=60 | No Redemption |

| >60 and <=2 Lakhs | Partial Redemption* | ||

| >2 Lakhs | Partial Redemption* |

Please Note: The minimum transaction amount specified in the above table is based on a minimum threshold of 300 Axis Bank EDGE REWARD Points or EDGE MILES.

*Partial redemption is allowed for lower of transaction amount or available equivalent reward points. For transaction greater than INR 2 lakhs, redemption can be done for points worth up to INR 2 Lakhs only.

**Redemption at IKEA is possible only for IKEA card holders.

Please Note:

- Full redemption – Cardholder will get SMS only if the customer has Axis Bank EDGE REWARD Points / EDGE Miles equivalent to transaction amount done by the cardholder on eligible MCC.

- Partial redemption – Cardholder will get SMS if the cardholder does a transaction as per the above-mentioned grid and has Axis Bank EDGE REWARD Points / EDGE Miles to partially redeem the transaction till the equivalent value of minimum threshold amount.

Is there any maximum cap for SMS Based Redemption? Yes, there is maximum amount cap of INR 2,00,000 per transaction. Any cardholder performing a transaction above the maximum cap would be allowed to redeem till the lower of maximum cap amount or EDGE REWARD Points / EDGE Miles available in their account.

Should you have any queries, please call us on <18604195555> / <18605005555> (charges applicable) or <18001035577> (toll-free).

Pay By Reward is a redemption option that allows you to redeem EDGE REWARD Points / EDGE Miles against your credit card outstanding balance.

Request for reward redemption can be placed via any of the below ways.

- Mobile Banking App - Log in using your User ID and MPIN, navigate to the Credit Card section, select the desired card, and choose "Pay Now" to access the redemption option.

- Axis Bank Internet Banking - After logging in, go to the Credit Card section, select your card, and click "Pay Now." You'll find the option to redeem points under "Pay by Rewards."

| Sl. No. | Credit Card | Reward Point Type | Cashback (Rs/point) |

|---|---|---|---|

| 1 | Axis Bank REWARDS Credit Card | EDGE REWARD Point | 0.20 paise |

| 2 | IndianOil Axis Bank Premium Credit Card | EDGE Mile | 1 Rupee |

| 3 | Axis Bank OLYMPUS Credit Card | EDGE Mile | 1 Rupee |

| Sl. No. | Credit Card | Reward Point Type | Minimum points required | Maximum |

|---|---|---|---|---|

| 1 | Axis Bank REWARDS Credit Card | EDGE REWARD Point | 10,000 | 50,000 |

| 2 | IndianOil Axis Bank Premium Credit Card | EDGE Mile | 10,000 | 50,000 |

| 3 | Axis Bank OLYMPUS Credit Card | EDGE Mile | 500 | 1,00,000 |